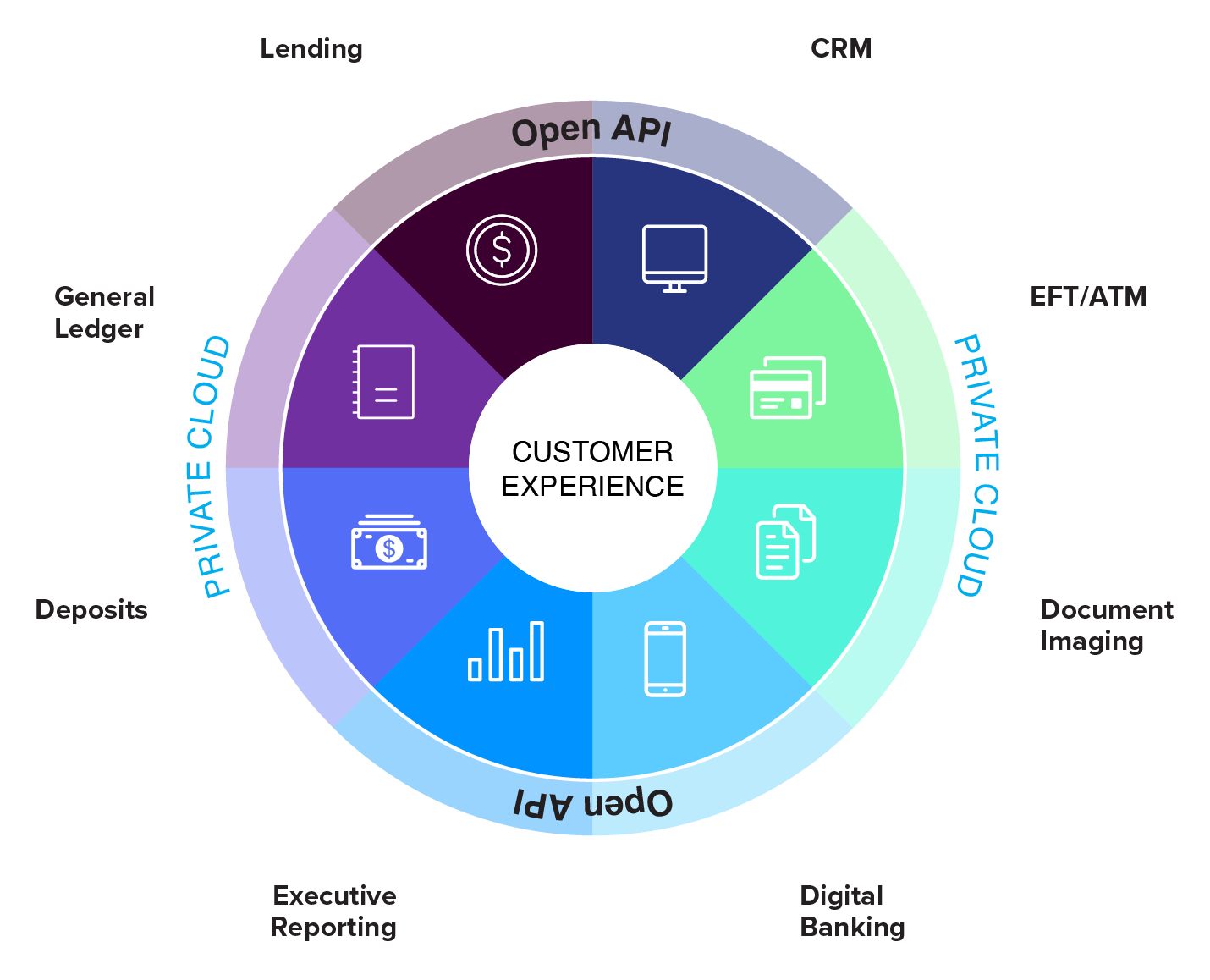

Enterprise Banking with Customer Experience at the Core

At its core, our enterprise banking model prioritizes the end user experience, because that is where new business is won and lost in today’s banking environment. Each segment of our enterprise banking solutions integrates directly into NuPoint, with the ability to connect third-party APIs.

- General Ledger: Record automated and integrated general ledger info into NuPoint

- Lending: Encourage digital lending and gain efficiency with integrated loan management and tracking solutions

- Deposits: Offer seamless mobile and general deposits for retail and commercial customers

- Executive Reporting: Quickly analyze the performance of your employees, customers and branches through detailed, ad hoc reports

- Digital Banking: Provide the security, data, reliability and customer experience that put you on an even playing field with the largest institutions in the world with our digital-forward solutions

- Document Imaging: Enhance the security and maintenance of digital documents with core-integrated document scanning and storage

- Payments Solutions: Gain next-gen digital payments, card processing and ACH/wire solutions that provide a superior customer experience

- CRM and Analytics: Capture and display customer data so you can track, view and analyze interactions across the entire customer lifecycle

Worried about a Core Conversion? Let Our Customers Put You at Ease.

At CSI, our innovative enterprise solutions come second only to our industry-leading level of service. Our core conversion team excels at executing seamless core conversions, even in a virtual environment. Take a look at what some of our current customers have to say about their conversion experience with us.