My Credit Manager

Credit Monitoring | Financial Education | Digital Engagement

Remain at the Center of Your Customers’ Financial Wellness with Credit Monitoring

Credit score monitoring is a critical component of consumers’ financial wellness. My Credit Manager from CSI is a fully integrated financial wellness solution that makes it easy for your customers to take charge of their credit, protect their identity and achieve their financial goals. Through our partnership with Array, My Credit Manager deepens relationships and engagement by providing customers with a complete picture of their finances in a single location. This one-stop shop allows your customers to access and monitor their credit within CSI’s digital banking platform and receive valuable financial education that empowers them to understand how financial actions affect their credit.

The Need for Credit Score Awareness

A recent consumer credit health survey from Discover found that 82% of respondents checked their credit score at least once annually and 56% are actively trying to improve their credit. But many consumers rely on resources outside their bank to help them manage their financial journey because their institution lacks a financial wellness strategy. This poses a massive opportunity for banks to deepen customer engagement and increase retention while serving as a trusted advisor at the center of their customers’ financial health.

My Credit Manager gives customers a 360-degree financial view within your digital banking platform. This fully integrated solution supports your customers on their path to financial wellness with 20+ embedded credit tools, including targeted offers and personal data protection.

Provide Complete Credit Literacy with a Suite of Credit Monitoring Tools

Assist customers on their journey to financial health by providing the right features, customized to their needs.

| Credit Score Show customers their credit score from one or more credit bureaus. With the credit score tracker, your customers can see how their score changes over time. |

Credit Report With 24/7 credit report access, customers can keep track of inquiries, open lines of credit and more, while keeping their credit in good standing. |

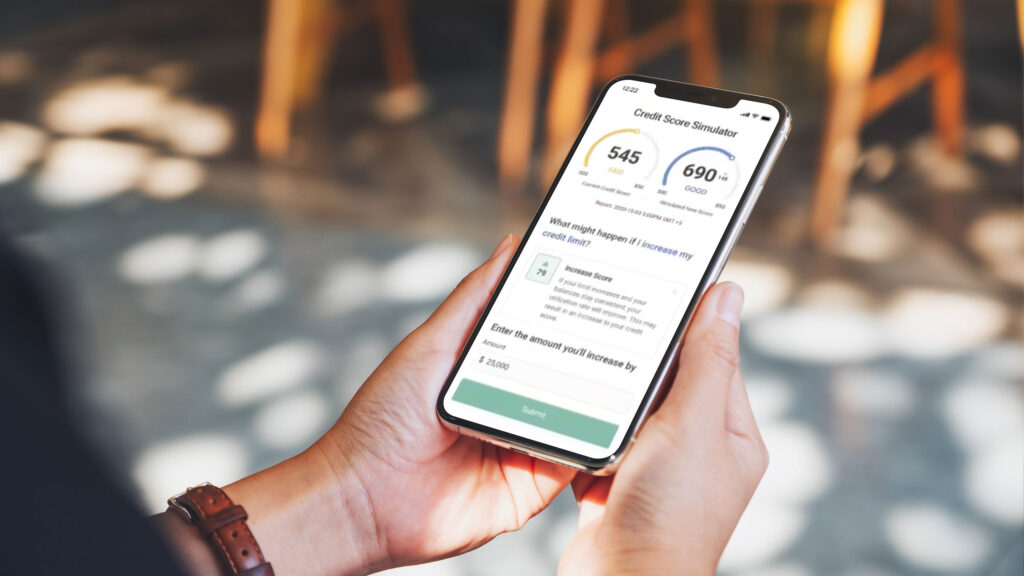

Credit Score Simulator Show customers how their score is affected by certain actions, such as opening a new credit card or taking out a loan. |

| Debt Analysis Let customers view and manage all debt in one location through your digital banking solution. |

Change Alerts Enable customer notifications for credit score or report changes, so they always have accurate information. |

Credit Education Help customers learn how to manage their credit score and keep it in good standing. |

Drive Revenue with Offers Engine

Through My Credit Manager, CSI offers targeted product recommendations embedded within your digital banking. Maximize your investment by leveraging valuable data—such as user credit health, liabilities and demographic analytics—to determine customer eligibility for your products and services. These targeted recommendations are enabled by custom rulesets determined by your institution and delivered through a seamless ad experience.

Maintain Security with Identity Protection

Identity theft can strike at any moment, jeopardizing your customer’s financial security and personal well-being. Protect what matters most with our add-on service, Identity Protection. We offer two levels of comprehensive identity safeguarding:

1. Identity Protection Light

Our Identity Protection Light package offers fundamental safeguards to keep your users’ personal information out of harm’s way:

Dark Web Monitoring: This service scans millions of servers, over 35,000 online chat rooms, message boards and more than 100,000 websites across the web’s darkest corners for any fraudulent use of your customers’ personal information, including usernames, passwords, IP addresses and NPI numbers. Your customers will receive instant alerts if their identity is detected on the dark web.

SSN Monitoring: Keep a watchful eye on your customers’ Social Security Number in real-time, detecting its usage in various scenarios like loan applications, employment records, healthcare records, tax filings, online document signings and payment platforms. Immediate alerts empower customers to take control of their identity before it’s too late.

Change of Address Monitoring: Unauthorized changes to your customers’ current or past addresses won’t go unnoticed. Identity Protection Light actively monitors the National Change of Address (NCOA) database and U.S. Postal Service records. Your customers will be promptly notified if a change occurs, ensuring their identity remains in safe hands.

2. Identity Protection Enhanced

Identity Protection Enhanced delivers added layers of security and support. This comprehensive package includes all the features of Identity Protection Light, plus:

$1 Million ID Insurance and Restoration Services: In the unfortunate event of identity theft, your customers are covered. A white-glove identity restoration service takes care of all the paperwork, phone calls and notifications needed to restore a user’s identity. Your customers can rest easy with up to $1 million in identity theft insurance underwritten by AIG.

Toll-Free Access to a Personal ID Recovery Specialist: Customers receive dedicated support from a personal ID recovery specialist who guides them through the entire restoration process.

Completion of Forms to Report Fraud to Police: We simplify the process of reporting fraud to the authorities, ensuring every step is handled efficiently and accurately.

One-on-One Guidance Throughout the Entire Process: With Identity Protection Enhanced, your customers receive personalized support and expert guidance to alleviate the stress of identity theft.

Backed by $1 Million Identity Theft Policy with $0 Deductible: Rest assured, your customers’ financial security is our top priority. This robust policy ensures they are protected with zero out-of-pocket expenses.

Don’t leave identity to chance. Fortify your defenses against the ever-present threats to your customers’ personal information and enjoy peace of mind knowing that their digital identity is in safe hands with Identity Protection.

For more information about My Credit Manager and Identity Protection, contact your CSI Relationship Manager today!