Optimize your lending workflows.

Unify disjointed systems into a single, streamlined platform and unlock the transformative power of automation with our Hawthorn River loan origination system (LOS).

Explore our loan origination system

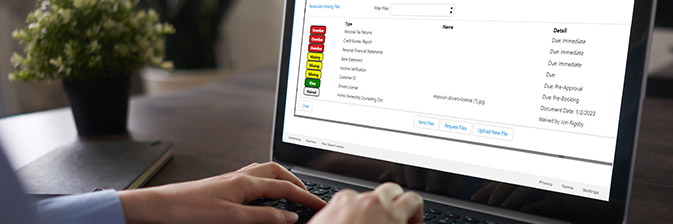

Automate away time-consuming, error-prone tasks

Boost lending efficiency with tailored end-to-end workflows, automation, and core system integration, cutting manual work and errors for all loan types.

Embrace digital lending

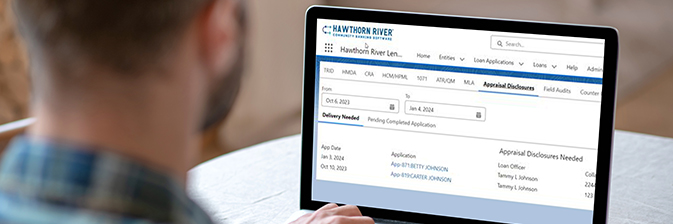

Simplify compliance with real-time clarity

Enjoy a smoother compliance experience. Track documents effortlessly, monitor regulations in real time, and gain clear visibility into loan progress, so you can spend less time worrying and more time closing loans.

Explore streamlined compliance

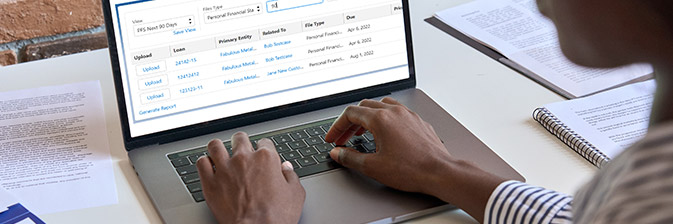

Take charge of your lending operations

Effortlessly manage past dues and maturities while streamlining loan committee tasks. Free up time and boost efficiency with intuitive tools that keep everything on track.

See our system in action

Better decision-making with powerful reporting

Unlock insights with built-in reports and dashboards, from forecasting funding needs to balancing workloads across the bank. Build custom reports on any data entered, keeping key information readily accessible.

Explore our loan origination system

Modernizing Your Lending Platform

Speed, simplicity and personalization: modern lending that sets your bank apart.

Read nowFrequently Asked Questions

Loan automation uses technology to streamline lending by reducing manual work and improving efficiency. It integrates with core banking systems to pull borrower data, automate loan documentation, track compliance, and handle tasks like ordering credit reports and appraisals. From consumer loans to complex commercial credits, it helps banks process loans faster, reduce errors, and stay compliant.

No, loan automation benefits financial institutions of any size, including community banks. Modern loan automation systems are designed to address challenges that can affect any financial institution, like manual data entry errors, compliance burdens, and disconnected systems. By replacing these disjointed technologies with a unified automation solution, community banks can process a wider range of loan types more accurately and efficiently, making them more competitive with larger institutions.

Yes, typically. Modern loan automation systems, like Hawthorn River, are usually designed to seamlessly integrate with existing core banking software, allowing information to flow between systems and eliminate inefficiencies like rekeying data. For example, through Hawthorn River’s integration with a variety of core systems, you can efficiently create loan applications for existing borrowers by automatically pulling data from your system, complete with support for complex borrower structures and cross-collateralization.