Compliance Tailored to Your Organization

For any successful business, growth is a natural part of the process — but as your clientele broadens, so do your organization’s KYC obligations under the USA PATRIOT Act.

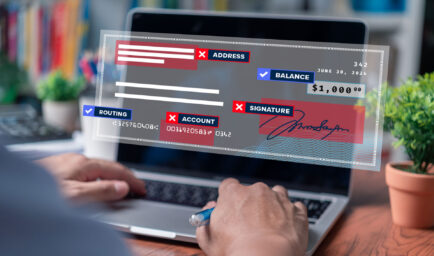

Simplify and enhance your company’s compliance efforts with CSI’s automated WatchDOG customer identification program (CIP) software. Our identity verification solution offers UI-based screening and monitoring that integrates directly with your existing systems and is customized to your organization’s risk profile.

Features

Scalable Screening Capabilities

Robust Customer Risk Profiling

Multiple Levels of Verification

Seamless API Integration

Why Choose CSI’s ID Verification Solution?

As a leading provider of digital identity verification, our goal is to simplify compliance for your business. Our identity verification solution helps you mitigate financial crime and strategic risk across your entire enterprise. Whether your customers are local or global, WatchDOG CIP offers ongoing risk profiling with alerts and customer profiles that monitor and predict potential impact to your business operations—and satisfy auditors.

- Manage volume, scale and internal bandwidth while staying compliant with KYC and USA PATRIOT Act regulations

- Streamline your compliance by integrating WatchDOG CIP into your existing workflow

- Leverage decades of compliance knowledge and 24/7 support from CSI’s Fintexperts™

Meet Federal Red Flags Rule Requirements

As a Red Flags Rule service provider, our certified consultants help you meet regulatory requirements under the USA PATRIOT Act Identity Theft Prevention Program for Red Flags Rules and support KYC compliance for financial institutions. Our identity verification services:

- Meet KYC regulations by checking customer information against the latest OFAC lists

- Verify that customers’ SSNs are not listed on the Social Security Administration’s Death Master File

- Authenticate all key customer information against public databases and the national consumer reporting agency files

- Reduce costs associated with identity theft prevention

- Limit your risk by enhancing your prevention tactics and scoring the validity of customer data