Technology you need, service you deserve.

See how the right technology and exceptional service helped this bank become a better version of itself and grow.

See more success stories

A cloud-based core built for you

CSI’s holistic core is built with your needs in mind, making it easier than ever to serve customers and boost profitability. This single, easy-to-use platform consolidates all banking data and functions to streamline operations. You’ll love its ease of use. So will your customers.

Learn more about our core

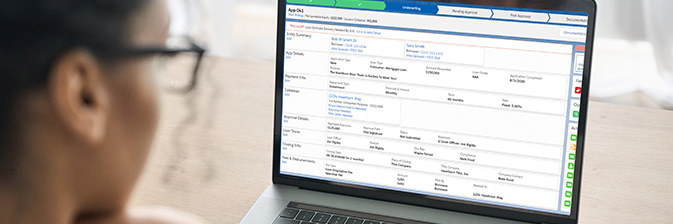

Consolidated, streamlined lending

Hawthorn River’s core-integrated loan origination solution simplifies lending operations for everyone involved. With automation, detailed analytics and a seamless digital experience, it’s designed to increase digital engagement, lending efficiency and revenue generation. Plus, our integrated loan management system allows you to track documentation, optimize interest rates, provide reminders and more from a single platform.

How our banks diversify loan portfolios

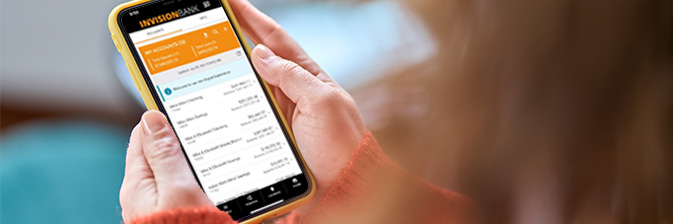

The latest in digital banking technology

Attract, onboard, engage and safeguard your customers with top-notch digital banking technologies. Our integrated digital banking solutions empower you to digitally transform your business and create a customer-centric digital experience to rival anything else on the market.

Our digital banking solutions

Lightning-fast payments processing

Revolutionize your institution’s payment infrastructure with our integrated processing solutions. Through offerings like FedNow Instant Payments, P2P, ACH, wire processing, cards and more, you can choose the fastest and most cost-effective payment rail. Ultimately, this modern approach simplifies transactions for your bank, branches, merchants and customers.

Today's digital payment trends

Flexibility and adaptability for the future

Whether you want to add new products from an already integrated fintech or develop your own CSI-integrated APIs, we’ve got you covered. CSI’s Open Banking Marketplace showcases integrated third-party solutions designed to extend your core banking platform. And our developer portal guides you to develop your own CSI-integrated solutions. By unlocking faster integration and new business models, CSI’s open banking platform will keep you adaptable and competitive for many years to come.

Explore open banking

CSI Enterprise Banking Solutions

Cloud-based banking technology designed to fit your bank’s unique needs.

Read nowFrequently Asked Questions

Think of core banking software as the underlying technology that tracks and handles every function of a bank’s business. Connected to and updated by subsidiary applications like digital banking, this central software provides the technological infrastructure for activities like onboarding and tracking customers, servicing loans and processing withdrawals and deposits.

Ultimately, a core banking system provides a stable central infrastructure to perform banking tasks faster and with less likelihood of error. It helps modern banks function by consolidating all data and processes into one easily accessible application. Functions include:

- Consolidating data from in-branch, mobile and online banking

- Processing loans, account opening, withdrawals and other transactions

- Storing essential records such as customer account balances and preferences

- Offering insight into performance and profitability

Although every bank must seek the core solution that best fits its unique needs, there are some must-haves to compete in a digital-first world. A modern system must enable secure transaction processing and eliminate data silos, even as new technologies and capabilities are added. Key features include:

- A single, unified platform with an intuitive user interface

- API integration that enables the institution to add new products and services as needed

- Cloud infrastructure that enables the bank to securely scale as it grows

- Business intelligence and analytics so that data informs investments and service

- Simplified loan management to maximize returns and minimize risk

- Fraud detection and risk management with alerts and smart automation

Although the specific timeline for a core system conversion depends on factors like vendor and the institution’s size, it requires months of strategic planning, data analysis, configuration to unique specifications and data transfer. Training often occurs throughout the process, with more hands-on training for staff, as well as rigorous testing and adjustments in the final weeks leading up to go-live. Most aspects occur behind the scenes to avoid any business interruptions for the converting bank, including conversion finalization, which typically takes place over a weekend.