A Solid Enterprise Banking Foundation

When you’re building a bank from the ground up, you need reliable and comprehensive banking technology that will grow with you. When you partner with CSI, you’re ready right out of the gate.

- Set Your Bank Up for Success: CSI’s complete enterprise banking solutions contain or integrate with all the technology you need to grow your assets and build your customer base, while providing a flexible platform for future scaling and innovation. We help lay the groundwork for the success of your customer interactions, employee efficiencies and banking operations.

- Focus on What You Do Best: CSI enterprise banking solutions streamline management of your De Novo’s core, digital banking and payments technology, saving the costs and difficulty of assembling an in-house development team. And with industry-leading customer service, you’re never alone. When you don’t have to worry about your technology, you can focus on what you do best: banking.

IT Infrastructure You Can Depend On

Stepping into a crowded financial sector, your bank needs an IT infrastructure that delivers a competitive edge with modern and scalable solutions. Whether you need , disaster recovery capabilities or a total IT cloud solution, an IT partner who knows your industry and its regulations is critical to keeping your bank’s environment running smoothly.

- Reduce Costs and Save Time: With so much to establish in the process of launching your bank, reducing the upkeep of your IT environment is critical. Support your IT team by partnering with CSI.

- Build the IT Infrastructure You Need: Unlike many IT service providers, CSI specializes in IT for financial institutions and is fully compliant. While some IT providers require you to buy cookie-cutter services, our flexible service model lets you customize to meet your unique vision.

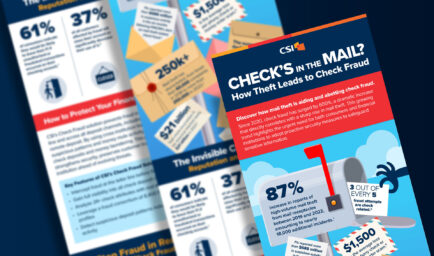

Know Your Bank is Protected with Managed Cybersecurity

A cybersecurity incident can seriously derail your plans for growing your bank, and with cyberattacks growing in frequency and sophistication every day, the risks have never been greater. From ransomware to DDoS attacks, your bank needs defense against a variety of threats.

- Keep Your Bank Safe and Compliant: CSI’s comprehensive managed cybersecurity services ensure that your bank is safeguarded against threats from day one. With 24/7 monitoring from our SOC, real-time reporting, penetration testing and more, your bank is always covered.

Lower Risk and Simplified Compliance

Strict federal regulations surrounding cybersecurity, sanctions screening and KYC compliance make it more important than ever for banks to work with a trusted regulatory compliance partner. Our solutions keep your bank compliant with today’s top federal regulations, including OFAC, USA PATRIOT Act, FinCEN, Gramm-Leach-Bliley Act, BSA/AML and many more.

- Protect Your Reputation: Failure to meet federal regulations can harm your bank’s first impression in the market and sow doubt among your new customers. Having compliance failures exploited by cybercriminals, money launderers or terrorists is even worse. CSI keeps your bank fully compliant and secure with a full suite of cybersecurity services, KYC and AML solutions and automated, real-time sanctions screening.

- Protect Your Bottom Line: CSI’s regulatory compliance services and tools discover and remediate vulnerabilities before federal auditors find them, protecting your bank from fines and disciplinary actions.

Streamlined Communication

Effective communication between your employees, leadership, and customers is vital at this critical time in your bank’s story. Efficient document management and distribution helps you increase customer engagement, improve productivity and lower costs. CSI’s comprehensive suite of document services puts time and resources back in your pocket, freeing you up to focus on your growth strategy.

- Engage With Customers: Statements are a critical customer touchpoint. CSI’s digital document solutions wow your customers with hyper-personalized and interactive digital statements, fostering engagement with your new customer base.

- Improve Efficiency and Lower Costs: Our print and mail services are more cost effective than in-house processes, streamlining your staff’s time and resources. Distribution scales easily, allowing your print mail delivery to grow with your bank.

- Enhance Communication: Internal communications can make or break a business. CSI’s business intranet solutions make collaboration faster and easier for your employees and leadership, ensuring everyone has the information they need when they need it.